Federal Budget to Include Tax Increase for Wealthiest Canadians

In an exclusive report by Radio-Canada, sources reveal that the upcoming federal budget will introduce a tax hike targeting the wealthiest individuals in Canada. While the exact nature of the tax measure remains undisclosed, senior Liberal sources indicate that it will impact less than 1 percent of the Canadian population.

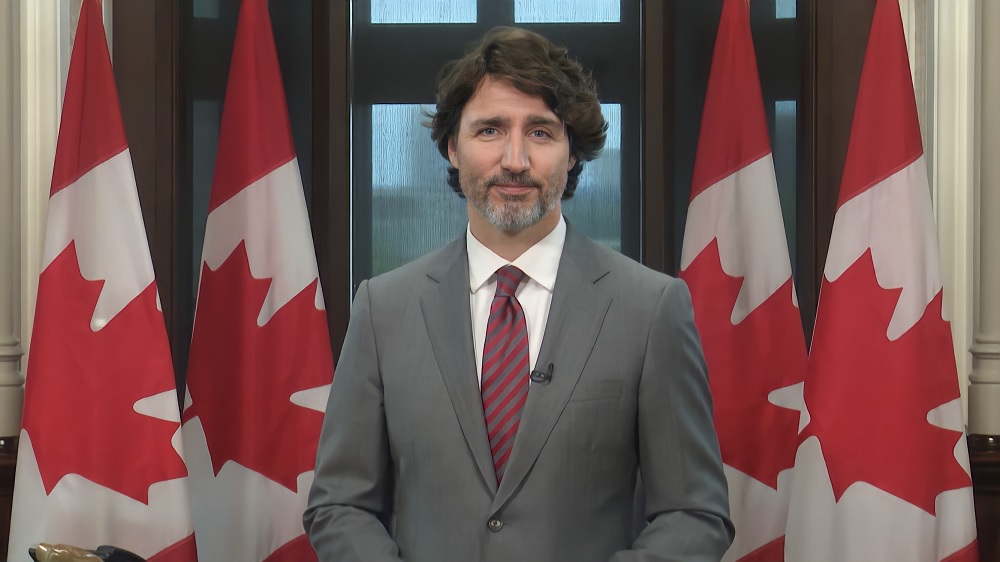

Prime Minister Justin Trudeau and his cabinet have embarked on a nationwide tour in recent weeks, announcing a series of pre-budget initiatives totaling over $38 billion in commitments spanning several years. Notably, approximately $17 billion of these commitments involve loan-based programs, suggesting that around $21 billion could directly impact the government’s fiscal bottom line.

Finance Minister Chrystia Freeland has emphasized the government’s commitment to supporting hardworking middle-class Canadians

With much of the spending agenda already unveiled to the public, tomorrow’s budget announcement is expected to focus on how the government plans to finance these new initiatives.

Finance Minister Chrystia Freeland has emphasized the government’s commitment to supporting hardworking middle-class Canadians, reaffirming that tax increases targeting this demographic are off the table. However, the Trudeau administration has a history of implementing tax reforms aimed at wealthier segments of the population.

Last year’s federal budget saw the introduction of significant changes to the alternative minimum tax rate, affecting individuals earning more than $300,000 annually. These measures underscore the government’s ongoing efforts to ensure a fair taxation system that addresses income inequality.

Moreover, the House of Commons finance committee has proposed the implementation of a windfall tax on companies across all sectors, particularly those generating “oversized” profits during crises, along with grocery giants. The revenue generated from such a tax could potentially fund an expansion of the GST rebate, benefiting low and middle-income Canadians.

As anticipation mounts for the federal budget reveal, all eyes will be on the government’s fiscal strategy and its approach to balancing economic recovery with progressive taxation policies. Stay tuned for further updates and analysis following the budget announcement.